9 Ways to Cut Costs on Health Benefits in 2020

January 27th, 2020

Can you believe it’s 2020? The future is here! And with the new year comes a new budget. If your resolution is to cut costs on health benefits, EBMS has some ideas for you.

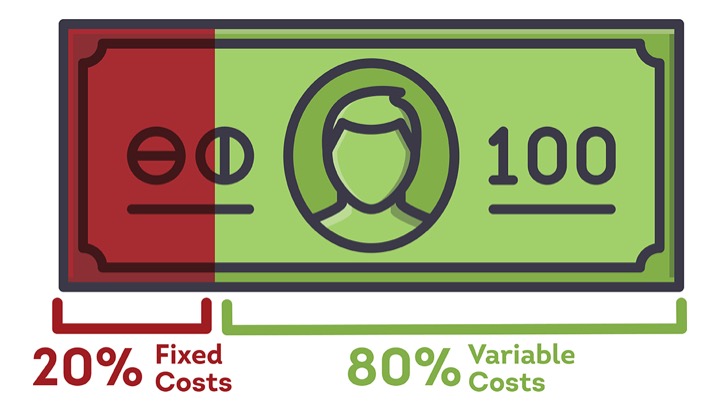

All of these cost-cutting methods are based on a concept we think of as 80/20. For every dollar your plan spends, 20% goes to fixed administrative costs while the other 80% goes to variable costs – mostly in the form of claims.

Too often, people get hung up on finding ways to lower fixed costs. They mistakenly believe it’s difficult to exert control over the variable cost of medical claims each year. Yet, that’s exactly what these nine strategies do, with dramatic results.

Too often, people get hung up on finding ways to lower fixed costs. They mistakenly believe it’s difficult to exert control over the variable cost of medical claims each year. Yet, that’s exactly what these nine strategies do, with dramatic results.

1. Make “cost transparency” your mantra. There are some really great transparency tools out there – let’s all use them! When your members can see the price of health services, they make more informed choices. It’s a win-win. They save on out-of-pocket expenses and your plan saves big time.

2. Implement metric-based pricing programs. This could either complement a strong PPO network, or replace the network entirely. Your members benefit from an open network, while you gain significant control over the cost of facility-based care. While a negotiated contracts with your PPO might save you 40% on the most expensive claims, reference-based pricing can easily bring savings of 65-70%.

3. Get serious about preventive services. We have witnessed it many times: a plan makes primary care more accessible and subsequently reduces high-dollar claims over time. It’s a no-brainer – when you support members with a chronic condition, they are less likely to develop costly complications. EBMS clients have realized tremendous savings through employer-operated, on-site and near-site primary care centers.

4. Exercise control over benefit design. Your plan should be structured to guide members toward high-value care and help them access the lowest-cost option that is appropriate for their condition. EBMS is an industry leader in this area. Our miChoice solution has demonstrated success at promoting positive utilization patterns and cutting the costs associated with inappropriate care.

5. Dangle the carrot with financial incentives. Programs designed to steer patients toward higher-value, lower-cost care work best when members are incentivized by waived deductibles and co-pays. But remember to put quality first. EBMS would never direct a member to a facility with a poor quality rating in order to save a buck.

6. Ditch your traditional pharmacy benefit manager (PBM). Consolidation among PBMs has led to a lack of price transparency. We guarantee you’d be shocked at how much money your traditional PBM is pocketing. There are better options! It would take us a matter of a few days to show you alternatives and how much it would save you, all while still giving your employees better options at a cost savings.

7. Choose your partners carefully. Who are you getting in bed with? Ideally, you want to work with brokers, third-party administrators, and other vendors who stay up to date on the industry, engage with you, and actively deliver cost-containment ideas.

8. Add 21st century telehealth services. This is 2020 – why wouldn’t you offer high-tech, 24/7 access to care? Virtual visits cost less than a traditional office visit and can prevent unnecessary visits to Urgent Care or the ER. Surveys show consumers are satisfied with them. Telemedicine is one of the biggest trends in healthcare right now.

9. Get really creative. Follow the lead of progressive companies that are thinking outside the box – and consider using novel strategies like medical tourism and on-site primary care clinics to manage costs. Your account manager can run the analytics and show you how much these strategies would be able to save your plan.

Are the wheels turning in your mind yet? If you would like more ideas or a personalized review of your plan, call the EBMS account team for a more in-depth discussion of how these ideas might work for you.